Equity crowdfunding, A.K.A Regulation Crowdfunding (Reg CF) continued to gain major momentum in 2020.

This method of crowdfunding allows creators to source investments from a crowd of investors. Equity crowdfunding is awesome because it gives early-stage companies easier access to capital—and if the company does well—investors reap big benefits by getting in on the ground floor.

These are high risk, high reward investments. Just like every startup company, those using equity crowdfunding are prone to fail.

But for investors that make informed choices and companies with a thorough understanding of best practices, there is really an opportunity on both ends to hit big.

I’ve been talking to tons of successful startups that have raised huge sums of money with equity crowdfunding on my Podcast, so make sure to check that out.

In this article, I’m going to take you through some key statistics from the equity crowdfunding industry in 2020.

Let’s dig into the numbers!

Top Equity Crowdfunding Sites of 2020

When it comes to equity crowdfunding, three major players are responsible for most of the money raised in the industry.

WeFunder

Leading the charge is WeFunder, which was responsible for over one-third of all money raised through equity crowdfunding.

To date, WeFunder has funded 500+ startups with almost $200 million. It also boasted the largest average check size on any of the three major platforms by over $100.

Not to mention the $2 billion+ invested in WeFunder’s portfolio after campaigns were completed.

StartEngine

StartEngine is WeFunder’s largest competitor, accounting for about 30% of all Reg CF dollars raised in 2020.

Backed by Mr. Wonderful Kevin O’Leary, StartEngine has asserted itself as a major player in the equity crowdfunding industry, with more and more startups turning to the platform for results.

To date, StartEngine has funded more than 375 companies with $300 million invested, benefitting off a few major campaigns that raised huge totals.

StartEngine itself is also publicly traded at $13 per share, with an overall valuation of $220 million.

Republic

Republic might be one of the lesser known equity crowdfunding platforms, but it still accounted for over 20% of all money raised in the industry.

The company focuses on four major categories:

- Startups

- Real estate

- Video Games

- Crypto

Republic’s thriving equity crowdfunding community boasts over 800,000 members, and raised about $150 million in 2020 alone.

Republic also had the most active investors of any of the three major players, with almost 40% of their community putting money towards a campaign in 2020.

Top Equity Crowdfunding Campaigns of 2020

Some campaigns really stood out in 2020, taking this emerging market by storm.

These companies clearly had the best understanding of equity crowdfunding best practices, putting them at the top of the pack.

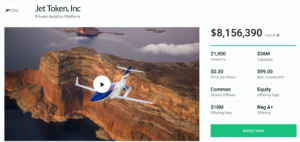

Jet Token is a private jet membership and booking platform that allows people to use one app to book a private jet, commercial airline ticket, or both, all on the same itinerary.

The startup made waves in 2020 on StartEngine, raising in excess of $8 million from 21,900 investors.

With just a $99 minimum investment, investors were granted access to the next age of aviation for a fraction of the cost of a company trading on the stock market.

Fancy.com boasts itself as the latest, most unique social commerce platform to discover, share, and shop amazing products.

Launching on WeFunder in 2020, nearly 700 investors contributed in raising about $500,000 to launch the website.

Fancy is a perfect example of just how dynamic this industry is, quite literally serving to create a new social platform from a crowd of investors.

Intellivision has used technology, creativity, and unrivaled passion to bring family and friends together through gaming.

Clearly, common gamers are growing tired of the increasingly isolating and complicated nature of modern video games.

This campaign raked in over $6.3 million from 2,300+ investors on Republic! Those are some impressive numbers.

Equity Crowdfunding Growth

The overall structure and distribution of crowdfunding funds is changing.

In 2016, the lending market accounted for 70% of the entire industry. While this is still the primary method of crowdfunding, things are changing in favor of an equitable approach.

Equity crowdfunding is growing at more than 3x the rate of the rest of the industry, which is no small feat.

According to Research and Markets, the global growth of the crowdfunding market is expected to occur at a compound annual growth rate of 16% over the next five years.

That means that equity crowdfunding could grow by up to 50%, further threatening the traditional lending market.

While 2020 certainly took a large toll on overall global investing, the equity crowdfunding industry did not see the same trends.

In fact, Q3 in 2020 saw the largest numbers in equity crowdfunding to date, raising $72.9 million. This dethroned Q4 of 2019 as the biggest year yet, where companies raised $59.1 million.

Companies have raised $410.5 million via regulation crowdfunding to date.

The top industries are as follows:

- Food and Beverage: 11.4% of total funds

- Software & Development: 8.3% of total funds

- Technology: 8.1% of total funds

- Media & Entertainment: 7.3% of total funds

Other Notable Statistics and Trends in 2020

Gender played a significant role on the startups side, with all-male founding teams accounting for 73% of filed offerings versus just 27% for teams with at least one female co-founder.

The most common security types to raise funds via Reg CF are:

- SAFEs – 27.5%

- Debt – 25.3%

- Common Stock – 20.9%

The SEC released a press release that outlined the following:

- A raise in the offering limit in Reg CF from $1.07 million to $5 million

- A removal of investment limits for accredited investors

- Using the great of annual income or net worth when calculating investment limits for non-accredited investors

- 18 month extension of temporary relief for certain Reg CF financial statement review requirements offering $250,000 or less of securities

Conclusions

Equity crowdfunding is here to stay.

This growing industry is taking crowdfunding by storm, going to work for both startups and investors.

With growth rates in the industry expected to reach around 50% in the next five years, now couldn’t be a better time to get involved.

Thinking about launching an equity crowdfunding campaign for your startup? Schedule a free coaching call with me—I’d love to help you out!

I have a great book out there, Equity Crowdfunding Explained, which takes you way more in depth on everything you need to know about the industry.

You should also check out my Podcast, where I talk with tons of successful equity crowdfunders for all the best advice, and subscribe to my Youtube Channel, where I’m also putting out a ton of great content regarding crowdfunding best practice.

It’s time for equity crowdfunding to go to work for your startup!