For those of you who may not know, Fund Wisdom is a company that connects investors and entrepreneurs with “financial wisdom”. You can use the site to access real-time data from a range of crowdfunding platforms.

“We collect the latest crowdfunding deals across the industry, analyze them and make all the information available to you in one location.” – Source.

In an effort to bring more data and credibility to the equity crowdfunding arena, Fund Wisdom has published a 2014 Online Equity Investment Insight Report.

In an effort to bring more data and credibility to the equity crowdfunding arena, Fund Wisdom has published a 2014 Online Equity Investment Insight Report.

The report consists mostly of generally solicited offerings of startups raising their seed round, listed between January 1 2014 and December 31 2014. The data used in the report contains information from a wide range of platforms, including: AngelList, SeedInvest, WeFunder, Onevest, Fundable, EquityNet, Return On Change, CrowdFunder, EarlyShares, and AGfunder.

The information collected by Fund Wisdom makes it easier for entrepreneurs to decipher the answers to important questions and gain insight into the world of online equity investment. Here is a glimpse of a few of the interesting things that this report touches on:

How much is getting invested over time?

Investments were fairly steady throughout the year – around $1 to $5 million – with two significant spikes. The first spike occurred in March, when Life360 raised $50 million (1% of which was transacted through AngelList). The second was a $17 million real estate investment that was listed on EquityNet.

One investment trend that Fund Wisdom noticed was the tendency to use equity funding platforms as a marketing channel, while the majority of large investments are still happening offline.

Top 6 valuations

1. Life360 (equity): pre-money valuation $175 million, $50 million raised

2. BIC Bakersfield (equity): pre-money valuation $48 million, over $5 million raised

3. Clearly Canadian (convertible debt): pre-money valuation $30 million, over $375 thousand raised

4. Quants (equity): pre-money valuation $23 million, over $235 thousand raised

5. Nimble (convertible debt): pre-money valuation $20 million, over $1.7 million raised

6. ZHRO (equity): pre-money valuation $17 million, over $500 thousand raised

The top two preferred choices for firms raising in 2014 were equity at 54% and convertible debt at 34%.

Platforms

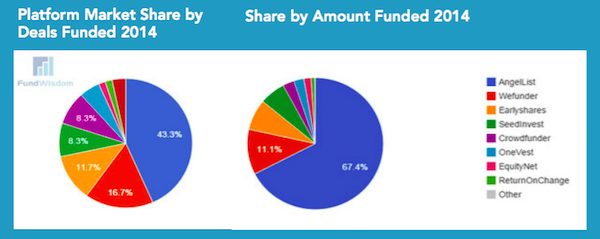

Market share by deals funded:

- AngelList: 43.3% (26 deals)

- Wefunder: 16% (9 deals)

Market share by amount funded:

- AngelList: 67.4% (over $77 million raised)

- Wefunder: 11.1% (over $12 million raised)

Of all the platforms included in this report, AngelList seems to have attracted the most investment activity in 2014 when it comes to number of deals funded and overall investment amount. WeFunder came in second, but funded less than half the number of deals that AngelList did and raised nearly 6 times less than AngelList.

It is important to note that these statistics include only public deals, making it hard to give more information for platforms with a lot of private listings. The full report contains more help choosing which platform to list with (including costs for investors and entrepreneurs).

Equity crowdfunding platform self-funding

Another interesting trend that has been talked about a lot recently is the fact that many crowdfunding platforms have undertaken their own fundraising efforts to improve their services and technology. AngelList raised the most by far at $24 million; SeedInvest raised $5.3 million and Crowdfunder $4.9 million. Other crowdfunding platforms did not take on any self-funding in 2014, including: Return on Change, Fundable, TradeUp and AGfunder.

Industry

Top 3 sectors by number of offerings:

1. E-commerce

2. Enterprise software

3. Entertainment

Top 3 sectors by amount raised:

1. Mobile and wearable technology

2. Real estate

3. E-commerce

From these lists we can see that one sector that is doing very well is e-commerce, which was the top sector in number of offerings and third in amount raised. Mobile and wearable technology was the sector with the largest amount raised, with real estate in second. Real estate crowdfunding has been taking some large leaps in recent years.

Conclusion

The difficulty with this kind of project is the fact that most times online funding amounts are actually only a fraction of the total amount invested. In many cases it is hard to pinpoint how much money was transferred online.

“As of October 24th, 2014, 113 equity offerings have closed their round. The average round size of deals was $2.3 million. IT funding lead throughout the year. Throughout 2014, online equity investment was fairly steady with roughly $1 to $5 million of investment activity week by week.”

Fund Wisdom has made it their mission to help provide insight and transparency into the world of online equity investment. They continue to release quarterly reports to give stakeholders valuable information on top platforms, entrepreneurs, and investors.

You can download the full report here.