Fundrise and Lending Club are two companies that you can use to get funding for a real estate deal.

While they both specialize in increasing access to capital through crowdfunding, they are extremely different companies.

As an investor or a borrower, you’re going to need to know how these two platforms compare and differ in order to make a smart choice with your finances.

With this blog post, I’m going to get you up to speed on both of these websites quickly. I’ve written dozens of articles on each of them. Now, it’s time to discuss how they line up!

If you’re interested in learning more about real estate crowdfunding, I’ve put together a free course which walks you through some of the major websites out there in the industry.

This is a step-by-step free course that you’re gonna want to join if you’d like to find out the best practices when it comes to this alternative finance topic.

Fundrise

Fundrise was founded in 2012 with the dream to democratize the way that real estate properties are funded. Using crowdfunding, the company links up sponsors with investors to make a deal happen.

In recent years, they’ve transitioned from a traditional real estate crowdfunding model to a eREIT business, where both accredited and non-accredited investors can access their various eREIT products.

These eREITs include the Income, Growth, West Coast, Heartland, and many more. They vary based on objective, geographic focus, and dividend payment.

This is now the main way that Fundrise encourages investment into private real estate. After raising funds from a group of investors, Fundrise then goes out and selects the properties that the overall fund is going to invest into.

Rather than selecting the individual properties that you’re going to put your money into, Fundrise now does it for you.

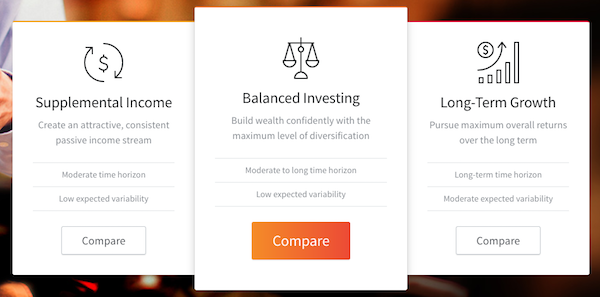

Another major change in recent years is that Fundrise offers new portfolios depending on your appetite for risk. These include the Supplemental Income, Balanced Income, and Long-Term Growth options.

You can use these various portfolios to help direct your investment on Fundrise.

Lending Club

Lending Club is another awesome alternative finance platform that you can use to get a healthy return on your money, or borrow money to finance a fix a flip and other real estate opportunities.

The main difference between Lending Club and Fundrise is that Lending Club is a debt-crowdfunding platform. This means that you can INVEST in the debt of other users on the platform.

As they pay back their debt, you’ll accumulate interest payments, just like if you personally lent them money.

Rather than loaning a friend $40,000, you can put a few hundred or a few thousand into a loan and diversify among a group of other investors who are funding that loan.

One of the downsides of Lending Club is that the only offer fixed-income opportunities, meaning that you can’t participate in the capital appreciation of any of the assets.

Bummer!

But, if you have an appetite for risk, you can elect to fund one of the more risky loans. That way, you’ll get higher returns.

Which is Better For Investors?

This is a hard question because you’re comparing apples and oranges. They are very different from one-another.

The great thing is that you don’t need a tremendous amount of capital to test the waters. You can invest on Fundrise for as little as $500 and $1,000 on Lending Club.

I think the decision comes down to:

- Fixed income vs. equity

- Appetite for risk

- Asset class

- Capital at your disposal

I’ve certainly seen more institutional investors get involved on Lending Club initially, but it looks like we’re beginning to see a shift, where more and more big funds are looking into real estate crowdfunding.

Which is Better for Borrowers?

If you are a real estate development firm with a proven track record, then I’d definitely recommend courting some of these platforms like Fundrise.

These guys are seeing massive influxes of funding and they need to get rid of the cash. Of course, it has to make sense and be a win all around.

If you’re an individual who is just getting started doing fix and flips or small deals, you could look into Lending Club as a way to get an unsecured personal loan.

You could also use RealtyShares to access hard money lending and fund your property fast.

What About Other Options?

The good thing is that there are many options when it comes to grabbing an unsecured personal loan online.

For example, you could check out Upstart, which allows you to get a loan up to $50,000 and also consolidate your debt.

Along with the traditional FICO score and years of credit, Upstart takes other components into account when deciding your rate, like your education, job history, and area of study.

If you’re looking for other real estate crowdfunding websites that you can use to get funding, you’re also in luck!

I’d take a look at RealtyShares, another major player on the block, along with EquityMultiple.

The only down side with these two websites is that you must be an accredited investor in order to access the deals on their platform.

This means that you must have an annual income of $200,000 or a net worth of $1 million excluding your house.

As you can see, this area is hot for disruption! Lots of new companies and websites. I’m excited for you and look forward to sharing more blog posts, videos, and podcasts to help share good education as you progress along this journey.