In 2023, the crowdfunding industry as a whole has continued to show promise.

Real Estate Crowdfunding (REC), also known as real estate syndication, was no exception.

In this article, I’m going to take you through some of the most recent statistics pertaining to Real Estate Crowdfunding to give you some insights into the health of this industry.

Let’s get into it!

What is Real Estate Crowdfunding?

Real Estate Crowdfunding allows individuals to pool their financial and intellectual resources to invest in properties that are larger than investors could individually afford or manage on their own.

This form of crowdfunding exploded following the 2012 JOBS Act empowering individual investors to access a real estate market that was previously accessible only to ultra-high net-worth people.

Real Estate Crowdfunding makes real estate syndication possible for everyone.

A sponsor sources, develops, and manages a real estate property on behalf of a group of investors. The sponsor takes on the sweat equity, while investors provide the financial equity.

Make sense?

If you need some more conceptualizing as to how this process works, check out my book or this Youtube video for a more in-depth description of the ins and outs of Real Estate Crowdfunding. Get the free audio book with Audible’s 30-day Free Trial.

Now that we’ve worked to define Real Estate Crowdfunding and understand how it makes the real estate investing market more equitable, let’s get into some of the stats produced by the industry as of 2023.

Here’s what we’ve seen as of 2023:

- The global real estate crowdfunding market is expected to reach around $230 billion by 2030.

- Over the past seven years, investors have seen an average return of 4.08% for all public U.S. REITs, peaking in 2021 at 39.88%.

- During the COVID-19 pandemic, real estate investments remained resilient, reaching an all-time high in many areas.

The industry’s estimated market value exceeded $10 billion in 2021 and continues to grow globally, with the United States and Canada continuing to lead the charge. However, the market has recently seen a huge boom in many Asian countries, namely South Korea, India, Japan, and China.

In 2020, residential properties were the primary source of real estate crowdfunding investments, accounting for over 50% of all crowdfunded real estate investments.

However, as of 2023 commercial and industrial properties have begun to overtake them, and institutional properties are also showing growing promise. This could mean lucrative future gains for investors ready to support these particular high-risk, high-reward plays.

Statistics for Prominent Real Estate Crowdfunding Players

In this article, we’re going to focus on three of the major REC players:

These three companies serve as the leading brokers between sponsors and investors in the Real Estate Crowdfunding Market.

Let’s dig in!

Fundrise

Fundrise requires a minimum initial investment of $10 from investors and charges an annual advisory fee of 0.15% per $10 invested.

The average annual return for investors since 2017 is 5.29% peaking in 2021 with a return of 22.99% across all clients.

Fundrise currently claims over 381,000 active users and $7 billion in total portfolio value. Of that total value, $311 million has been passed off to investors in the form of net dividends earned.

You can check out the 200+ properties available for investment in Fundrise’s catalogue here.

As these statistics show, this company has demonstrated consistent growth over the years, and despite the struggling stock market of 2022, it doesn’t appear to be slowing down any time soon!

CrowdStreet

Portland-based Crowdstreet specializes in connecting accredited investors with a broad range of debt and equity commercial real estate investments, with a particular focus on “secondary cities” with lower valuations, higher net rental yields, and potentially higher growth.

The platform also offers three unique ways to invest:

CrowdStreet has a super high minimum starting account balance of $25,000, but does not charge account fees.

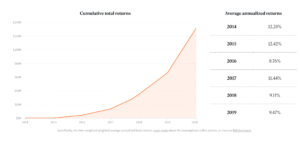

Since the company’s launch in 2014, it’s published 752 commercial real estate investment offerings, 157 of which have been fully realized today.

With $4 billion in capital raised through the CrowdStreet marketplace, business is certainly booming on the platform.

RealtyMogul

Realty Mogul charges a $5,000 minimum investment and assesses a 1-1.25% per year asset management fee.

The platform boasts access to private market offerings that have led over 274,000 investors to join RealtyMogul, pumping in over $1 billion in investments to date.

Over $5.9 billion in deals have been posted on the platform to date.

RealtyMogul has seen 224 total realized investments, bringing investors nearly $210 million in returns.

Conclusions

Real Estate Crowdfunding (REC) is here to stay.

Based on these numbers, it’s clear that there is a ton of potential for this sector of the crowdfunding industry to go further.

REC makes real estate investment opportunities available to the average person, not just the super-rich.

If you’re looking to diversify your financial portfolio, statistics show that Real Estate Crowdfunding is a pretty good bet going forward.

Three companies are leading the way:

- Fundrise

- CrowdStreet

- RealtyMogul

Between these three, we’ve seen over $12 billion dollars invested into the real estate market by ordinary people like us. Not too shabby – and you could be betting a cut of that pie.

Looking to do some more research about the benefits of Real Estate Crowdfunding?

Check out my book, Real Estate Crowdfunding Explained, and subscribe to my Youtube Channel, where I’m always chugging out tons of helpful content about all things crowdfunding.

I hope these statistics have been informative and helpful for you as you make financial decisions going forward.

Good luck with your future investments!