Fundable is an equity crowdfunding platform that you can use to raise capital or invest in startup companies online.

At the time of writing, more than $411 million in funding has been committed on Fundable across a variety of different industries.

It’s clear that equity crowdfunding is disrupting the way in which startups are financed. If you’d like to discover more about the top platforms, I’ll link you to my new guide, Equity Crowdfunding Explained.

With this post, I want to discuss the benefits and drawbacks of the Fundable fundraising website, along with what you need to know in order to get started.

I hope this article clears up some of the major questions in your mind when it comes to equity crowdfunding, who it’s for, and how you can use it to accelerate the growth of your company.

How Fundable Works

Unlike other websites, Fundable operates as both a rewards-based and equity crowdfunding website (that functions more as a database).

Rewards-based crowdfunding is similar to Kickstarter. Backers are gaining access to “perks” or “rewards” when they pledge money to your project. This could be an early version of the finished product, or an initial production run of the end product.

Equity crowdfunding is when an entrepreneur gives away shares in their company to investors who then become partial owners in the startup. It’s like doing an initial public offering on the open market.

As a founder, you can offer investors equity and convertible/non-convertible debt in your startup. You’ll simply create a profile, set up your terms, structure your deal, get approved, and then market your project.

Your investment will then be available for accredited investors to browse on the platform.

The important thing to note is that Fundable is not a broker dealer. As the website says, “Legally we cannot charge fees after funding for equity. All funds transfers, final deal terms and legal documentation are worked out between the investor and company directly after the end of the fundraise off-site.”

This means that “Any fees charged are up to the discretion of both you and the individual investor, and you can investigate methods of transferring the money between yourselves.”

Fees and Costs

Fundable operates a bit differently from some of the other equity crowdfunding websites out there. They don’t take any kind of success fee or fees related to the amount that you’ve raised.

Instead, Fundable charge $179 per month to create and manage your fundraiser and use their platform. This is a software as a service model. You’re paying to use their software and gain access to their marketplace.

Now… you might be thinking that’s too good to be true, right? If you’re doing a fundraising campaign for six, seven, or eight figures, traditionally, you’d expect a much more hefty fee.

In my opinion, the reason why that Fundable is able to make this model work is that they are very hands-off with the entire equity crowdfunding process.

They basically give you a database of people who are accredited investors and it’s up to you to connect with them, market your project, and get funding.

It’s up to you to figure out how to do final deal terms, legal documentation, and fund transfers. When browsing their help section, their default answer was pretty much “get legal counsel.”

For rewards-based campaigns, Fundable does charge a 3.5% + $0.30 per transaction WePay fee.

Who Can Invest on Fundable?

Only accredited investors can invest on Fundable. You must meet the yearly income and net worth threshold. Investment minimums start at $1,000.

It’s very important to note that the actual funding transaction will not happen on Fundable. It will be handled individually by the company/investors.

The only thing you’re doing when you “invest” on Fundable is make an investing commitment.

Basically, you’re gaining access to a database of startups that are looking for funding and by expressing interest, you’ll telling one of those startups that you’re ready to invest in them.

Who Can Raise Money on Fundable?

At the time of writing, only US-based companies can raise money on Fundable. You can think of the website as a skeleton of the deal that you are going to offer investors.

As it says, “Ultimately, a company’s agreements with the investor and SEC fillings are what determines how much can be raised and how much can be oversubscribed.”

This language leaves the deal terms pretty open, meaning that most of the work is going to happen behind the scenes with your legal counsel in drawing up documents and figuring out the details of the offering.

You can see some of the recently funded campaigns below.

There are companies in the technology, food, and even the energy industry.

Fundable Popularity and Statistics

According to the website, more than 377,000+ entrepreneurs have joined their community and successfully raised millions in private capital from investors. The homepage states that companies have raised more than $411 million on the site.

The company that owns Fundable also owns Startups.co, Bizplan, Clarity, Launchrock, and Zirtual. It’s clear that they’re trying to provide an all-around solution for startups and entrepreneurs.

Would I Recommend Fundable?

I gotta be honest and say that NO I would not recommend using Fundable.

For all of the work that goes into an equity crowdfunding campaign, you’re better off going with a platform that has its incentives more aligned with your success.

In my opinion, these guys basically give you the software to make a campaign page and a database of investors.

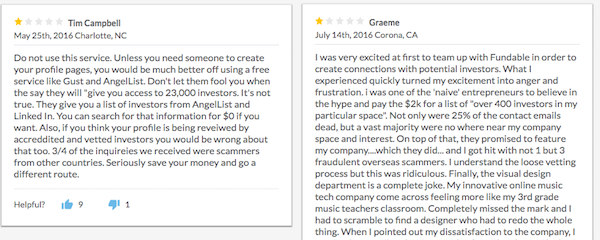

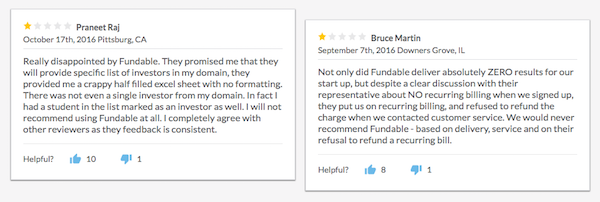

I also looked up some reviews of this platform and came across many that were questionable like those below.

Again, this is my opinion, but it seems to me like this platform wants to be very hands-off and that’s just not practical for an equity crowdfunding campaign. You need a lot of horsepower behind the financial raise and good quality leads that aren’t burnt out.

I think they’re trying to get a lot of people to use their software on a monthly payment basis, as that’s their business model. The things they say and do will be aligned with getting more longterm users of their software. That’s not necessarily the best thing.

I could be wrong, so I invite you to do your own research. Having reviewed other platforms, these were my thoughts.

If you know what you’re doing when it comes to doing a equity crowdfunding campaign and all you need is the software tools to do it, then I think these guys might be worth looking into.

I hope you got some value from this article. I also reviewed other platforms in my guide, Equity Crowdfunding Explained. You can also discover some of the tips and advice I have for putting together an effective marketing strategy.