Fundrise lets you invest in private real estate projects online from the comfort of your home.

You can use the site to put your money into REAL properties (without having to actually manage, identify, or acquire them). Then, you just sit back and enjoy the passive income.

In other articles, I’ve covered some of the differences between Fundrise and RealtyShares, along with all the other real estate crowdfunding websites out there.

Today, I want to in-depth with Fundrise and review their service. We’ll cover who should use them, what benefits they offer, as well as the clear drawbacks of using their platform.

By the end of this review, you should have a much better idea of whether or not you should look into this site for your investing game plan. Hope you enjoy.

What is Fundrise and Why Is It Different?

Fundrise is an investment platform that you can use to discover private market real estate deals. These are deals that are NOT easily accessibly by the general public and are not publicly traded.

As an investor, you can choose from a variety of different eREITS and investment plans that will put your funds into debt and equity real estate assets. These are also known as privately traded REITs.

Basically, Fundrise will identify, manage, and acquire the properties for the portfolio. They are using your investment ($500 minimum) and others in order to grow and manage the portfolio. You just have to sit back and experience resididual income and appreciation from your investment.

The website is different for a few key reasons, including:

- Privately traded REITs

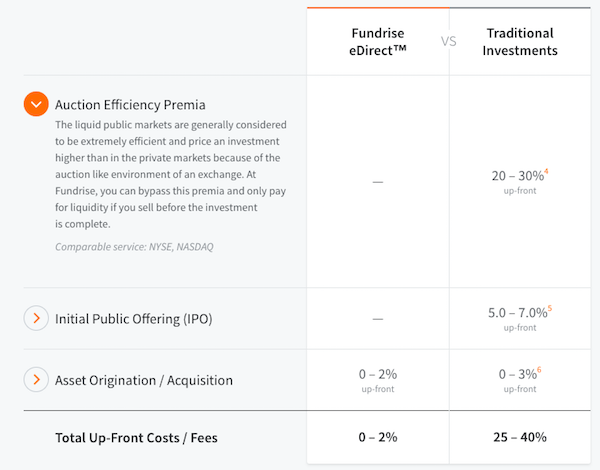

- Save up to 40% typical costs through technology

- Access private real estate deals

- Mix and match dividends/appreciation strategies

Fundrise is one of the first companies to really pioneer the use of Regulation A+ of the Jobs Act as a tool to raise money for real estate. This is how they are able to raise funds on a continual basis and also add new properties to their mix.

By using these new set of regulations, Fundrise brings large-scale private real estate opportunities to the ordinary retail investor. You don’t need $100k to be able to invest in real estate anymore. You can do it for as little as $500.

Private Investments are More Profitable

Fundrise was created off of the belief that private investment opportunities are more profitable that public opportunities. Let me explain.

Most REITs are publicly traded, meaning that their value will fluctuate over time depending on the value that investors assign to the asset. On Fundrise, there are only privately traded REITs. There is not an open market for the financial asset.

As a result, when you’re investing in something like a public stock, the price is not only dependent on the inherent underlying asset, but also the perception of that fund and asset in the overall marketplace.

This perception can create unjustified prices and lead to paying more for shares than they are actually worth (at the same time – you are also buying the liquidity benefits of the market).

Finance professor Dr. Aswath Damodaran is quoted as saying that “the illiquidity discount for a private firm is between 20-30%”, meaning that publicly traded assets have an inherent markup price.

Real Estate is Indestructible

Unlike other types of investments like stocks, startups, and commodities, real estate is unique in that historically, it has seen excellent returns. According to the website:

“Fundrise investors can earn up to 10.9% annual returns by investing in a diversified portfolio of private market real estate assets through our technology platform.”

In comparison, “An investment portfolio made up of publicly traded equities (stocks), has earned an average 8.2% annual return over the past 20 years.”

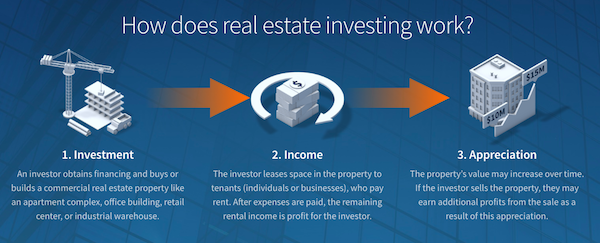

The reason that real estate is an indestructible investment is that your investment is growing in value in terms of monthly cashflows AND appreciation.

This means you’re getting consistent cashflow from the tenants of the real estate (businesses or individuals) and you’ll experience extra profit when the property is sold for a higher price. That’s a double-punch knockout!

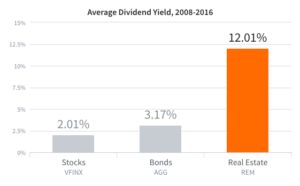

Of course, you could generate cashflows from investing in bonds or high yield dividend stocks, but they are much smaller than that which is generated from real estate investments.

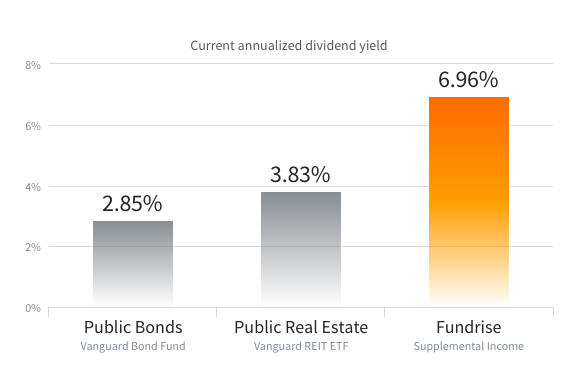

Of course, you could generate cashflows from investing in bonds or high yield dividend stocks, but they are much smaller than that which is generated from real estate investments.

Taken from 2008 – 2016, the average dividend yield was about 4x higher than from bonds and 6x from stocks.

Meaning, if your goal is to generate cash flow through an income investing strategy, then real estate is certainly the way go to.

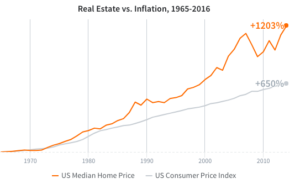

As you might be thinking, this makes real estate a great hedge against inflation, or the general rise in prices. As the prices rise, so will the intrinsic value of your real estate investment.

As you might be thinking, this makes real estate a great hedge against inflation, or the general rise in prices. As the prices rise, so will the intrinsic value of your real estate investment.

When prices range, so do the prices that new tenants are offered. This translates into ever-increasing profits for you, making it so the intrinsic value of your investment is not eaten away by inflation.

Add in the fact that:

- Real estate is inherently limited (from a geographic standpoint)

- The population is always increasing

And you’ll find yourself at an indestructible investment vehicle.

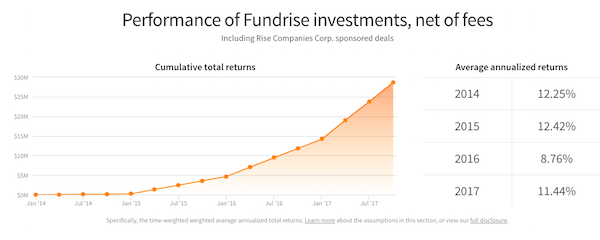

Historical Fundrise Returns

In the past, Fundrise has been averaging a return of between 8 – 12% like clockwork. It’s no surprise, considering they’ve invested approximately $1.4 billion to date in real estate around the country.

Compared to income-producing investments like public bonds or public real estate, they’re doubling their competition at 6.95%. Pretty impressive.

This means that if you’re trying to generate cashflow from your investments to help fund your lifestyle, then real estate is a great option. It clearly has higher yield than other options, like dividends from public stocks.

Of course, past performance is no indication of future results. However, it is one of the elements that every investment advisor will tell you to examine before jumping into a deal or adding a new asset to your portfolio.

While “real estate crowdfunding” might seem like a new term in the alternative finance arena, it should be taken seriously. Literally, billions of dollars are being invested through this platform and others out there, like RealtyShares.

Considering that the investment minimums right now are pretty low ($500), I think it’s pretty easy to get started and see whether or not Fundrise is a good fit for you. Let’s talk about a few ways to do that.

Investment Plans

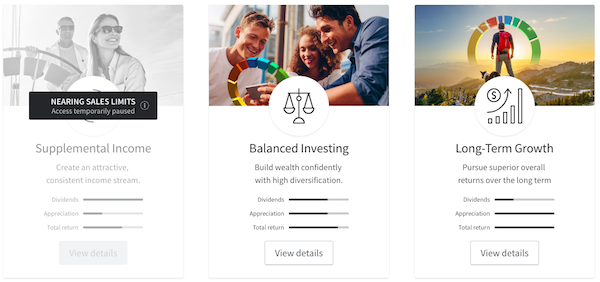

There are several different plans that Fundrise has created to cater to the various types of investors that are out there. In general terms, these include Supplemental Income, Balanced Investing, and Long-Term Growth.

Supplemental income aims at a 6.6-7.3% dividend return and a 1.9 – 3.1% appreciation in your investment for a total of a 8.5 – 10.4% return. Naturally, this plan is aimed at those individuals who want to receive cashflow on a quarterly basis.

Over the course of 25 years, this could grow $10,000 worth of principle to more than $96,000+ at these rates. This is achieved between a mix of 80% debt investments and 20% equity investments.

Balanced investing aims at a 3.7 – 4.1% dividend return and a 4.3 – 7.7% appreciation in your investment for a total of a 8.0 – 11.8% return. This is best for those investors who don’t only want cashflows, but also want to build wealth through appreciation.

You’re going to see a similar overall return to the supplemental plan, however, the equity/debt mix is a bit different because you’re going for both quarterly cashflows and capital appreciation.

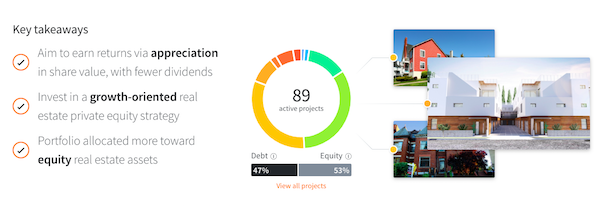

Longterm growth aims at a 2.3 – 2.5% dividend return and a 5.5 – 10.0% appreciation in your investment for a total of a 7.7 – 12.5% return. This is at the other end of the spectrum from the supplemental income plan.

The reason why is that it’s about a 50/50 distribution between debt and equity for the portfolio. The focus is on capital appreciation and longterm wealth building. The people in this plan are on the younger side.

Website Facts and Fees

Founded: 2010

Amount Invested: $1.4 billion

Historical Returns: 8.76- 12.42%

Minimum Investment: $500

Property types: Commercial, Residential, Single-Family

Financial types: Equity, Debt

Annual Fees: 1%

Upfront Fees: 0 – 2%

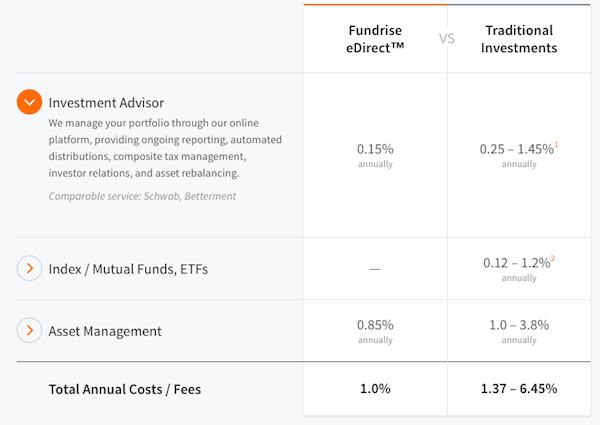

There are two types of fees that Fundrise charges. The first comes in the form of an annual fee that goes towards asset management and investment advisor expenses.

Along with these fees, the website also charges upfront fees that go into the asset acquisition and origination. Keep in mind that were you to go with a traditional investment plan, you’d also be hit with fees that go into the costs of investing. If you had a mutual fund manager, fees would also be attached to this.

So far, you have a pretty clear idea of the different plans offered by Fundrise, how it all works, and the fees that go into using their platform. Now, let’s get into the pros and cons of investing in real estate online.

Pros of Fundrise

Funrise is different from everything else out there. They’ve really been leaders in the real estate crowdfunding space. Whether it’s pioneering from a technology standpoint or using Reg A+ for real estate offerings, these guys are the real deal.

From a benefits standpoint, I think that Fundrise stands out for these reasons:

- Use of technology saves costs and cuts out middle man

- Simple to track portfolio and earnings

- Easy to diversify across multiple asset classes and real estate around the country

- Low minimums and completely passive cash flow

Basically, if you want to get into the real estate game, but don’t want to manage your own property, then Fundrise is for you. You can experience capital appreciation and quarterly cashflow payments that are 100% passive income for you.

These cash flows from real estate debt and rents can form a healthy and dependable income stream for you to live off of. If you’re in the younger phase of your career, you can build wealth through the capital appreciation that real estate experiences.

Cons of Fundrise

At the same time, there are several key drawbacks to using Fundrise that I want you to be aware of. This isn’t for everyone, so be sure to research your options before diving into real estate crowdfunding.

Some of the drawbacks to using Fundrise include:

- Less liquidity than a publicly traded REIT

- Limited to Fundrise’s access to property

- Annual asset management/portfolio fees

- May experience swings in market if real estate prices change

Now – historically, real estate has been a great hedge against inflation. However, the price of real estate is always fluctuating. If the prices go down, so will the value of your investment. It’s something to be aware of when you’re choosing which plan you want to use on Fundrise.

Get started with only $500

We’ve gone through some of the pros and cons, along with the fees that you should expect when signing up with Fundrise. Now it’s time to make a decision.

Today, you can get started with only $500. This is the lowest minimum that the website has offered in a while, and I don’t know how long it’s gonna last.

When you sign up, you also get the 90 day satisfaction period and the ability to upgrade to an advanced plan when you’re ready. It’s a no-brainer.

I hope that you’ve enjoyed this review. Whether or not you make use of real estate crowdfunding, I think it pays to look at some of the alternative asset classes that are out there.

You might not put ALL of your money into alternative investments, but they can make up a healthy portion of well-diversified portfolio and ensure that you not only grow your wealth, but also experience income-producing cashflows.

This post contains affiliate links.