SeedInvest is an equity crowdfunding platform that allows businesses in the startup phase to raise capital online from both accredited and non-accredited investors.

The crowdfunding site capitalizes on a piece of U.S Legislation signed in 2012 known as the Jumpstart Our Businesses (JOBS) Act which enables non-accredited investors to purchase equity in private companies that are looking to raise funds to scale their business.

In this article, we’ll be going through:

- The Founding of SeedInvest

- What is SeedInvest?

- Success Stories on SeedInvest

- Additional Resources For Equity Crowdfunding

Here we go!

Founding of SeedInvest

The SeedInvest equity crowdfunding platform was founded in 2012 and launched in 2013 by Ryan Feit and James Han. The company is headquartered in New York City.

Since the site’s inception:

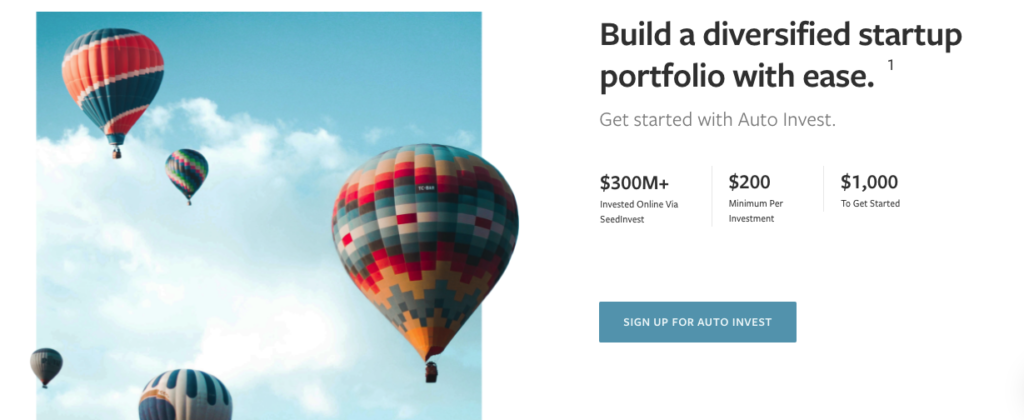

- $300 million+ have been raised

- 500,000+ total investors have participated

- 235+ offerings have been successfully funded

SeedInvest seeks to set itself apart from the equity crowdfunding pack by featuring only highly vetted investment opportunities. According to its website, SeedInvest has accepted less than 2% of all startups that apply.

You can read more about their vetting process and founding story in this New York Times article with Ryan Feit.

What is SeedInvest?

The concept behind SeedInvest is highly similar to other equity players in the crowdfunding space such as WeFunder, StartEngine, and Republic.

A distinguishing factor between SeedInvest and these other equity crowdfunding sites is that their minimum investment is $500. This is a higher minimum investment than most other platforms, many of which offer investments as low as $100.

Still — that $500 figure is 50 times lower than typical startup investments that would be required from an accredited investor.

The idea is that startups can spread the wealth in the form of financial returns for investors. For example, instead of raising $100,000 from a single investor, the platform allows the crowd to pitch in smaller totals to get that $100,000 mark.

The platform also offers a program called Auto Invest with a $200 minimum per investment. The focus of this program is diversification, allowing investors to build a portfolio of “up to 25 highly vetted, early-stage startups” to increase one’s chances of capitalizing on the 10% of startups that account for 85% of all investment returns.

You can think of SeedInvest and other equity crowdfunding sites as Kickstarter for investments.

However, on traditional crowdfunding platforms like Kickstarter and Indiegogo, backers receive a reward for their monetary support, usually coming in the form of a product. The SeedInvest Model uses Return On Investment (ROI) as a substitute for a reward.

SeedInvest poses greater inherent risk than backing a traditional crowdfunding project because investors have absolutely no guarantee of a return on their investment.

If an investor chooses a startup that does well, they’ll have a chance to see massive returns for getting in on the ground floor. But if the startup fails (as 90% of them do), the investor loses all their money.

Every investment strategy poses an element of risk and in the case of SeedInvest, investments are even riskier. But that hasn’t stopped investors from taking chances on companies that they believe in, typically playing with a buy-and-hold strategy that accrues over several years to see returns.

There are many examples of extremely successful startups on the SeedInvest platform that have gone on to acquire big economic gains and pay impressive dividends. Let’s take a look at a few of those now.

SeedInvest Success Stories

If you’d like a more comprehensive assessment of SeedInvest’s current and former offerings, make sure to visit their Browse Startups page.

Knightscope

Amount Raised: $18,734,460

Knightscope is a company that makes autonomous security robots that provide security professionals with advanced detection capabilities. Knightscope has been a big player in the equity crowdfunding space, also participating in fundraising rounds on sites like StartEngine. Their $18M+ raise was the most successful campaign in SeedInvest history.

HelloMD

Amount Raised: $3,094,722.15

HelloMD claims to be building the largest marketplace of cannabis consumers on the planet, deeming themselves the “Amazon of Cannabis.” The project is a great example of an innovative company raising funds to take hold in an emerging industry, in this case, cannabis, which has a revenue forecast of $84B by 2028.

Keen Home

Amount Raised: $4,647,776.74

Keen Home is a smart home technology company that is “making core systems of the home smarter, starting with the world’s first smart home air vent.” Their systems are currently sold in major stores like Lowes and BestBuy.

Additional Equity Crowdfunding Resources

Interested in learning more about SeedInvest and equity crowdfunding as an industry? We’ve got some great resources for you:

- What is Equity Crowdfunding?

- 6 Equity Crowdfuning Pros and Cons

- SeedInvest vs. WeFunder

- How Equity Crowdfunding Works (Video)

- What is Equity Crowdfunding? (Video)

Here at CrowdCrux, we’re all about leading the movement into the equity crowdfunding era with education. Stay up-to-date by:

- Subscribing to the once-weekly newsletter

- Checking out the Crowdfunding Demystified Podcast

- Subscribing to the Youtube Channel

- Finding the book: Equity Crowdfunding Explained

Thinking about launching your own campaign on SeedInvest? Book a coaching call with the founder of CrowdCrux Salvador Briggman. Our team loves working on equity campaigns, and we’re ready to take your fundraiser to the next level.

We hope that this article has been informative for you to learn more about SeedInvest and all the possibilities that come with it both for entrepreneurs and creators. The future of non-accredited startup investing is brighter than ever!