In the early stages of starting a company?

Looking to get funding for your startup?

It’s hard to raise capital in the early stages, especially when you might not even have a prototype yet.

You have to sell potential investors on the vision that you have, the problem you’re solving, and the product you’re looking to create.

Thankfully, there are some ways to get funding during this stage. In this article, I’m going to go through a few ways to do this!

Hope you enjoy!

1. Savings and Retirement Savings

Most entrepreneurs start their first company using their own savings. They plough their own cash into the startup before seeking outside capital.

You could draw on your personal savings or your retirement accounts to help fund the early activities of your company. Of course, there are some legal implications that come with using your 401k or IRA for these purposes.

It’s freakin’ risky, but if you truly believe in your idea and ability to execute, then it could end up being a winning bet.

Make sure that you keep track of all of your expenses so that you can eventually cut down on your taxes at the end of the year.

2. Friends and Family

This is the first source of funding for many startup companies. It’s what enables them to raise enough money to get off the ground.

These are the people in your life who care about you most. They want to see you succeed. They want to help you reach your goals.

But, you should treat them as investors. Put together a REAL pitch. Explain the risks and potential return. Treat them with respect.

If you can convince your friends and family to become an early investor in your company, then your prospects are starting to look good!

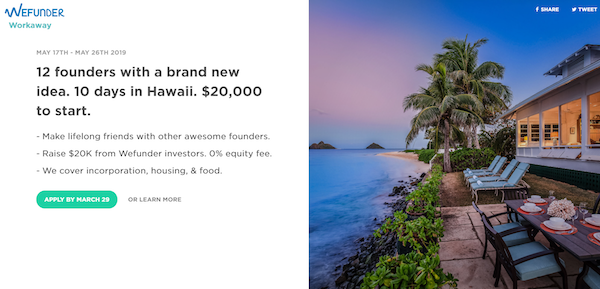

3. Wefunder

Wefunder is a crowdfunding platform that has a new initiative — called “Workaway” — focused on supporting founders with a brand new idea.

Successful applicants will be approved to raise capital from their own community, and Wefunder‘s network of 200K investors. And founders that raise at least $20K will qualify for a 10-day trip to Hawaii — to connect with other founders, and get world class mentorship and advice.

Keep in mind, this applies to ANY early-stage company — from tech startups to breweries.

To take advantage of this, you gotta submit an application by March 29, 2019.

Later stage companies can also look into Wefunder’s equity crowdfunding platform as a way to raise up to $1M from investors.

4. Loans and Credit Cards

When entrepreneurs have difficulty securing capital, they also use bank loans, online loans, and credit cards to help bridge the gap.

Typically, this is used to fulfill inventory needs, however it can also be used for other startup costs.

In the past, I’ve shared a few websites that you can use for these needs.

Keep in mind that you’ll have to pay back this money, so it does put an onerous burden on your company. You’ll have monthly expenses right out o the gate.

5. Angel Investors

You can court angel investors, or high net worth individuals, who can become the initial investors in your startup.

They can write a $10k, $25k or $50k check into your company. You also have bigger angels who invest larger amounts.

Usually, this initial funding round, which may be conducted with a few angels, is meant to help to get you from idea stage to prototype. That way, you can raise another round of funding to continue operations.

In order to go after these investors, you gotta have a professional pitch deck that conveys the value of the investment, the market opportunity, and how you’re going to execute with your team.

6. Crowdfunding

Crowdfunding is another great way that you can get some initial funding for your startup company.

You can launch a campaign on Kickstarter or Indiegogo to raise funds from the crowd. This could be for a tech product, creative project, board game, and more.

In the past, we’ve seen entrepreneurs raise six and seven figures with crowdfunding campaigns. This can go towards financing the initial order run of a physical product.

Once you’ve run a successful project, this could invite further rounds of funding from investors. It is also a killer media opportunity to get your brand on the map.

7. Sell Services

Lastly, you can sell services to your future customers!

This is how MANY established companies have started.

They first offered web development services or marketing services to their clients. Eventually, they built a tool that helped their clients and they moved from a service-based business to a product-centric one.

By selling services, you can get some revenue in the door which can then be used to finance product development. Once you get your product out there, the services can also finance marketing and advertising expenses.

While not thought of frequently, selling your time can be a great way to transition from a 9-5 job to a new startup company (without losing all your income).

Which is Best?

They all have their various pros and cons. Personally, I think you should first assess what resources you can bring to a startup and your family and friend network.

Then, you can go from there. Opportunities like Wefunder’s New Ideas initiative only come around once and a while, so if you ever find those, I’d take advantage of them ASAP.

Once you start raising money from outside sources like VCs and larger angels, it’s like putting your plane on a runway. Eventually, you gotta take off.

It’s going to be a lot of hustle and hard work, but eventually it will ALL be worth it. The long hours. The frustration. It’s how you turn small ideas into big companies.

Hope you enjoyed this article and you can join my newsletter below if you’d like more tips on crowdfunding.